Anti Money Laundering Act Designated Service

The idea of money laundering is very important to be understood for those working in the monetary sector. It is a course of by which soiled money is converted into clean cash. The sources of the money in actual are prison and the money is invested in a manner that makes it appear like clean money and hide the identity of the prison a part of the money earned.

While executing the monetary transactions and establishing relationship with the brand new prospects or maintaining existing clients the duty of adopting enough measures lie on every one who is a part of the group. The identification of such aspect to start with is simple to deal with as a substitute realizing and encountering such conditions in a while within the transaction stage. The central financial institution in any nation provides complete guides to AML and CFT to combat such actions. These polices when adopted and exercised by banks religiously provide enough safety to the banks to discourage such conditions.

Note 4 at the end of this reprint provides a list of the amendments incorporated. This means that Property Service Providers are among a number of professions who may be exposed to money laundering due to the nature of their business.

Pdf Compliance And Corporate Anti Money Laundering Regulation

A service that is listed in section 6 of the AMLCTF Act because it has been identified as posing a risk for money laundering and terrorism financing and which meets the geographical link.

Anti money laundering act designated service. Part 1 Introduction 1 Short title This Act may be cited as the AntiMoney Laundering and CounterTerrorism Financing Act 2006. This is a compilation of the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 that shows the text of the law as amended and in force on 20 December 2018 the compilation date. This Act is administered by the Ministry of Justice.

A if all of the designated services provided by the reporting entity are covered by item 54 of table 1 in section 6 and there is no joint antimoney laundering and counterterrorism financing program that applies to and has been adopted by the reporting entity. Compliance Officer Nomination Notification Form New - 3 May 2021. You must also register with AUSTRAC if the designated service you provide includes remittance service or digital currency exchange service.

If you provide one or more of these designated services and have a geographical link to Australia you are. The Criminal Justice Money Laundering and Terrorist Financing Act 2010 identifies Property Services Providers as Designated Persons. An Act to combat money laundering and the financing of terrorism and for other purposes Assented to 12 December 2006 The Parliament of Australia enacts.

VII of 2010 An Act to provide for prevention of money laundering WHEREAS it is expedient to provide for prevention of money laundering combating financing of terrorism and forfeiture of property derived from or involved in money laundering or financing of terrorism and for. Changes authorised by subpart 2 of Part 2 of the Legislation Act 2012 have been made in this official reprint. Check if you need to enrol.

The Central Bank of Ireland for credit institutions or financial institutions. The AMLCTF Act nominates certain types of services particularly in the finance gambling and bullion sectors as designated services because such services have been identified as posing a risk for money laundering andor financing of terrorism. Anti-Money Laundering Countering Financing of Terrorism and Targeted Financial Sanctions for Designated Non-Financial Businesses and Professions DNFBPs Non-Bank Financial Institutions NBFIs AMLCFT and TFS for DNFBPs and NBFIs New - 3 May 2021 APPENDIX 3.

Anti-Money Laundering Act As Amended on February 8 2021 SyCipLaw April 21 2021 4 designated pursuant to relevant United Nations Security Council resolutions and its designation processes Freeze Orders Pursuant to this policy the AMLC has been granted the additional function of implementing targeted financial sanctions. The notes at the end of this compilation the endnotes include information about amending laws and the amendment history of provisions of the compiled law. As a further step towards minimising the compliance burden it was decided to approach the new legislation in two tranches with the first tranche covering the financial services sector where they provide designated services and those businesses already subject to some anti-money laundering regulation as cash dealers under the Financial Transaction Reports Act1988.

Designated services include a range of business activities in the financial services bullion gambling and digital currency exchange. 59 rows ANTI-MONEY LAUNDERING AND COUNTER-TERRORISM FINANCING ACT 2006 -. An entitys AMLCTF obligations are triggered by the provision of a designated service with the obligations applying in respect of the customers of such services.

These activities are called designated services in the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 AMLCTF Act. Its an entitys customers of designated services that a company must know for the purpose of. If you provide one or more designated services as prescribed in the AMLCTF Act you must enrol with AUSTRAC and comply with the obligations set out in the AMLCTF Act.

CDD is one of the basic requirements of the risk-based AML approach and it has been deemed necessary and recommended by all regulators in the world within the scope of anti-money laundering. Anti-Money Laundering and Countering Financing of Terrorism Act 2009. Anti-Money Laundering Act 2010 Act No.

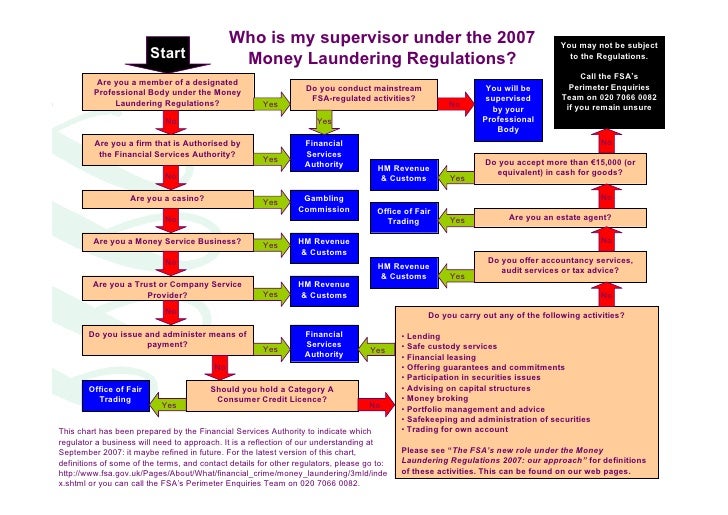

These services are designated in the Act because they have been identified as posing a risk for money laundering and terrorism financing. Designated services in the financial sector include. The Criminal Justice Money Laundering and Terrorist Financing Act 2010 establishes a number of competent authorities who monitor designated persons and secure compliance with the requirements of the Act.

Ppt Anti Money Laundering Aml Powerpoint Presentation Free Download Id 4491318

Anti Money Laundering Overview Process And History

1970 To 2021 The Us Anti Money Laundering Act History Complyadvantage

Money Laundering Money Laundering Financial Action Task Force On Money Laundering

1970 To 2021 The Us Anti Money Laundering Act History Complyadvantage

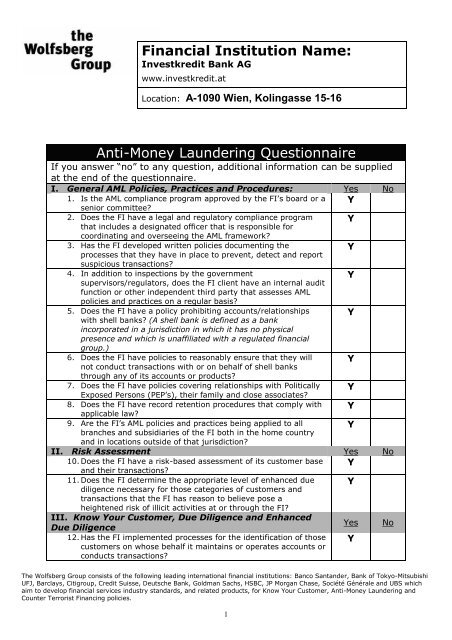

Anti Money Laundering Questionnaire Volksbank

Aml In Switzerland Reform Of Money Laundering Act Amla In 2021

Pdf Introduction To Money Laundering Ghulam Alosh Academia Edu

Updated Anti Money Laundering And Terrorist Financing Law In Uae

Anti Money Launder Aml Cft Guide Bi 260218 With Letter Money Laundering Government Information

Pdf International Anti Money Laundering Programs

Anti Money Laundering Course Bishkek Academy 2018

The world of regulations can seem like a bowl of alphabet soup at times. US money laundering laws aren't any exception. We now have compiled a listing of the top ten cash laundering acronyms and their definitions. TMP Danger is consulting firm centered on protecting monetary companies by lowering risk, fraud and losses. We now have huge bank experience in operational and regulatory threat. We've a powerful background in program management, regulatory and operational risk in addition to Lean Six Sigma and Business Process Outsourcing.

Thus cash laundering brings many opposed consequences to the group because of the risks it presents. It increases the chance of main risks and the opportunity price of the financial institution and in the end causes the financial institution to face losses.

Komentar

Posting Komentar