Money Laundering Regulations 2017 Summary

The idea of cash laundering is essential to be understood for these working in the financial sector. It is a course of by which dirty money is converted into clean money. The sources of the cash in precise are felony and the cash is invested in a manner that makes it look like clear cash and hide the id of the felony part of the money earned.

While executing the financial transactions and establishing relationship with the new prospects or sustaining existing clients the duty of adopting satisfactory measures lie on each one who is part of the organization. The identification of such aspect in the beginning is easy to cope with as a substitute realizing and encountering such conditions afterward within the transaction stage. The central financial institution in any country supplies full guides to AML and CFT to combat such actions. These polices when adopted and exercised by banks religiously present enough security to the banks to discourage such situations.

PDF 542KB 56 pages. Through its regulations FI contributes to the implementation of amendments to the Directive.

Anti Money Laundering Policy Pdf

Overview of The Money Laundering Regulations 2017 by guildy 27 Jul 2017 Lettings Options - Means of Managing Property Wales Lettings Options England New Legislation News The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 commenced on 26 June 2017 and replace the Money.

Money laundering regulations 2017 summary. On 26 June 2017 changes were made to UK anti-money laundering measures to help prevent money laundering and terrorist financing as well as increasing the transparency of who owns and controls companies in the UK. However MLR 2017 also require that any personal data in the CDD information and transaction data that firms are required to retain be deleted after a maximum of ten years. The government has implemented The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 that transpose the European Unions Fourth Anti Money Laundering Directive into UK law.

The Money Laundering Terrorist financing and Transfer of Funds Information on the Payer Regulations 2017 the MLR 2017 came into force on the 26 June 2017 repealing the Money Laundering Regulations 2007 2007 MLR and transposed the EU Fourth Money Laundering Directive 4MLD into UK law. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force in June 2017. Amendments to the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 Statutory Instrument 2022.

MLR 2017 retains the five years rule for record keeping after the relationship has been terminated. More prescriptive than previous legislation. The underpinning of this risk based approach is a risk.

The amendments enter into force on 1 January 2020. The regulations were effective from 26 June 2017. Our quick guide gives you an overview of the key issues firms need to be aware of as a result of the transposition of the Fourth EU Money Laundering Directive.

The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692 Money Laundering Regulations 2017 or MLRs 2017 form part of the UKs anti-money laundering AML and counter-terrorist financing CTF regimeThey apply to a wide range of businesses identified as most vulnerable to the risk of being used for money laundering and. This legislation built on the 2007 regulations although there are some specific and potentially significant changes that you need to be aware of and factor into your policies and procedures. Data retention policies need to.

In the second edition of Board Agenda. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the Money Laundering Regulations 2017 came into force on 26 June 2017. Board Agenda Money Laundering Regulations 2017 the key changes.

From June 26th the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force requiring firms who are subject to the MLR 2017 regulations to apply a comprehensive risk based approach to the risks of money laundering and terrorism financing. FI is adapting the regulations to amendments to the Anti-Money Laundering Act primarily due to amendments to the Fourth Anti-Money Laundering Directive. Today the Money Laundering Regulations 2017 MLRs 2017 or Regulations has become effective transposing Fourth Money Laundering Directive EU 2015849 -.

Anti Money Laundering And Counter Terrorism Financing

Anti Money Laundering And Counter Terrorism Financing

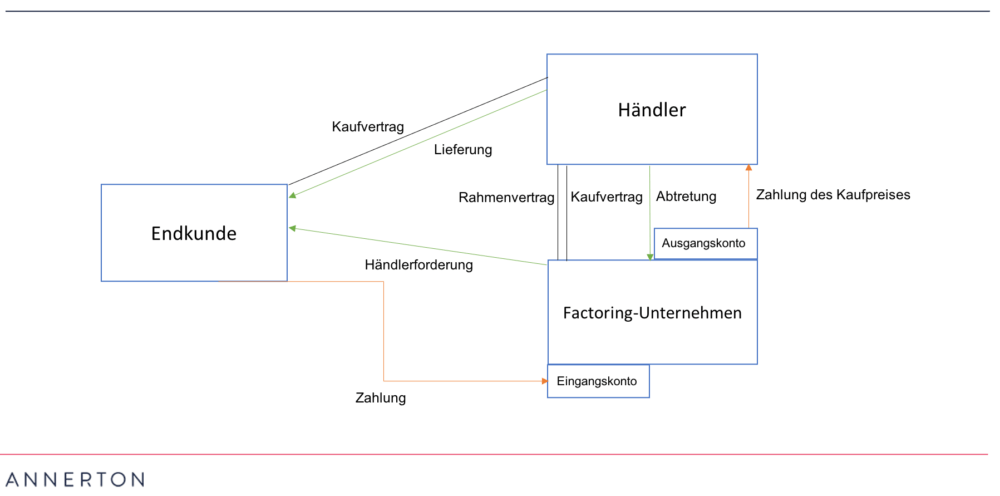

Factoring And Anti Money Laundering Law

Anti Money Laundering And Counter Terrorism Financing

1 Dymimic Estimation Of The Amount Of Money Laundering For 20 Highly Download Scientific Diagram

Anti Money Laundering And Counter Terrorism Financing

Overview Of The Money Laundering Regulations 2017 Grl Landlord Association

1 Dymimic Estimation Of The Amount Of Money Laundering For 20 Highly Download Scientific Diagram

Brief Summary Of The Money Laundering Regulations 2017

Anti Money Laundering Policy Pdf

Finalization Of The 4th Anti Money Laundering Directive Bankinghub

Anti Money Laundering Policy Pdf

Anti Money Laundering In Indonesia What You Need To Know

Money Laundering Process Download Scientific Diagram

The world of rules can seem to be a bowl of alphabet soup at times. US cash laundering laws are not any exception. We've compiled a listing of the highest ten money laundering acronyms and their definitions. TMP Danger is consulting agency centered on protecting financial companies by lowering risk, fraud and losses. We now have massive financial institution experience in operational and regulatory risk. We've a strong background in program administration, regulatory and operational risk as well as Lean Six Sigma and Business Process Outsourcing.

Thus money laundering brings many hostile penalties to the organization because of the dangers it presents. It increases the chance of main dangers and the opportunity cost of the financial institution and ultimately causes the financial institution to face losses.

Komentar

Posting Komentar